People lose thousands of their hard-earned money every year, simply because they can’t spot an investment scam when they see one.

While IT advances have made these scams a bit more difficult to identify, there are some telltale signs of a fake investment that are always sure to show up.

Here are 6 ways to identify an investment scam:

- Fear of missing out.

- Get 45% ROI in 10 days – an unrealistic offer.

- Vague business model.

- Unsolicited investment offers.

- Inconsistent online presence.

- Demanding referrals.

1. Fear of Missing out

An investment scammer will pressure you to invest ASAP by using phrases like ‘limited offer’ or ‘be among the first 20 people’ to paint their investment scheme as a once-in-a-lifetime opportunity.

The idea is to get you to put in your money without thinking about it.

In finance, A general rule of thumb is to wait for 24hrs before making any purchase, and that includes buying assets, too.

2. Get 45% ROI in 10 days

If the promised ROI looks too good to be true, it probably is.

Every investment comes with a certain level of risk, but investment scammers always promise ‘guaranteed’ returns.

Fake investments play on your greed, so be sure to always ask about the risk involved.

3. Vague business model

If you can’t point out what you’re investing in, that’s a red flag. Never buy investments you don’t understand.

The business model should be simple to grasp, and as an investor, you should understand where and how returns are generated.

In the world of investments, there are no secrets, so any investor who claims to have secret knowledge is most likely lying to you.

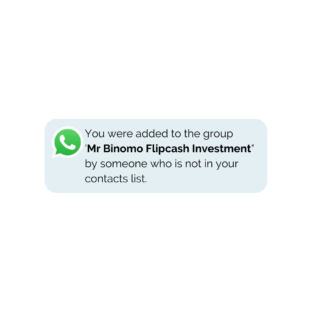

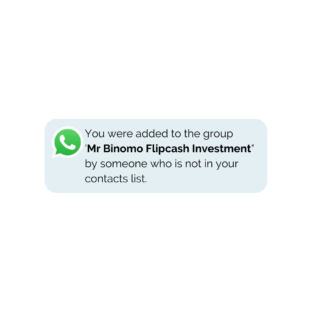

4. Unsolicited Investment offers

Legitimate investment firms won’t randomly contact you with ‘exclusive’ offers.

Cold calls, visits or emails that insist on you investing immediately should be received with caution.

Like we said before, wait 24 hours. Another way to spot an investment scam is to carefully do your research on every firm.

5. Inconsistent Online presence

Too much or too little online presence could be suspicious, so you should always do your due diligence.

Look them up online, check their social media pages, find out what others are saying about them and most important, speak to an expert.

Fake investment companies either have too little presence for all the buzz they generate offline or too much online activity, for a firm that was established so recently.

If in doubt, consult an expert to advise you on some safe investments in Nigeria.

6. Demanding referrals

If you have to bring in 2 people who will bring in 2 more people, then there’s no investment; this is what you call a Pyramid scheme or a Ponzi scheme.

The first person gets their returns by convincing those after him to invest, and the last investor is always the loser.

Your friends should not be your investment advisors. Take responsibility for your finances and do your research.

Final Thoughts

Learning to tell a fake investment apart from a legitimate investment will save you thousands of naira in your lifetime. The scammers are getting wiser, but you can always be a step ahead.

The key is to be patient and not be pushed by greed. Take your time before making investment decisions.

Remember that true wealth takes time to grow, but will outlive the owners

CURIOSITY AND GREED PULL PEOPLE INTO SCAMS.

– FRANK STALLONE

RECOMMENDED ARTICLES

- 4 Money Principles You Need to Know

- Ways to Build Wealth With Your 9 to 5

- How to Identify (and beat!) Your Spending Triggers

BRAVEWOOD was created to provide safe, high-yield investment options and help Nigerians like you build wealth, no matter how much you have. All of our products allow you safely grow your funds with minimum risk.

Sign up on www.bravewood.ng today to build your wealth the SMART way.