Remember when ₦20 could actually buy something?

If you’re old enough, you might recall the days when ₦20 could fill your stomach, fuel your car, or restock your pantry. Now? It practically doesn’t exist.

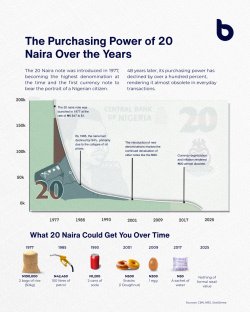

In the space of less than five decades, the ₦20 note has gone from being Nigeria’s highest denomination to an afterthought. But this transformation isn’t just about a note losing value; it’s the story of Nigeria’s economic journey. A story written with oil booms, policy U-turns, inflation spikes, and a recurring failure to learn from the past.

So how did we get here? What happened to the naira, and to the twenty-naira note specifically?

A Symbol of National Pride

When ₦20 was introduced in 1977, it was more than just a currency note. It was the highest denomination at the time and the first Nigerian note to feature a local figure: General Murtala Mohammed. It held significant purchasing power. With ₦20, you could buy:

• 2 bags of rice (50kg each)

• 100 litres of petrol

• A decent grocery haul for the week

The naira itself was strong. In 1977, ₦0.647 exchanged for $1. The Nigerian economy was buoyed by the oil boom of the 70s, and there was optimism in the air.

But that optimism wouldn’t last.

The 80s: Oil Prices Crash, and So Does the Naira

By 1985, just eight years after the ₦20 note was launched, its purchasing power had declined by 94%, thanks largely to the collapse in global oil prices. Nigeria’s overreliance on oil revenue was its Achilles’ heel.

The government’s response? The Structural Adjustment Program (SAP), a collection of economic reforms pushed by the IMF and World Bank, which included:

• Currency devaluation

• Deregulation of interest rates

• Trade liberalization

In theory, these reforms would force the economy to diversify. In practice, they weakened the naira, increased the cost of living, and accelerated inflation.

The Torrid Tale of Inflation

Throughout the 90s and early 2000s, Nigeria’s economy bounced between military rule, weak civilian institutions, and inconsistent economic policies. The naira kept losing value, and new higher denominations were introduced to keep up with inflation.

Fast forward to 2017, and ₦20 had become practically obsolete in any real transaction. Its value had dropped so significantly that it could only get you a sachet of water—barely.

By 2025, economists and market watchers agree: ₦20 has “no formal retail value.”

So, What Went Wrong?

The story of the ₦20 note is really a story of poor macroeconomic management. Here’s a breakdown of the key culprits:

1. Overdependence on Oil Revenue

Nigeria never truly diversified its economy. When oil prices took a hit, government revenues plummeted, and the naira took the fall.

2. Inflation

Nigeria has struggled with inflation for decades. Food inflation, fuel price hikes, and currency devaluation have created a cost-of-living crisis that eats away at the naira’s value year after year.

3. Currency Policy Instability

From fixed exchange rates to floating regimes, Nigeria has danced back and forth with monetary policy. The lack of consistency has made it hard for investors and citizens to trust in the value of the currency.

4. Corruption and Policy Misalignment

A recurring theme in Nigeria’s economic story is the mismanagement of public funds and policies that serve the elite at the expense of the masses.

In a nutshell, the fall of the twenty naira note is a sign of deeper economic strain.

You see, when small denominations lose value, everyday transactions suffer. It becomes harder to make change, harder to price goods affordably, and even harder to mentally track inflation.

Think about it: if ₦20 can’t buy anything, what happens when ₦50, ₦100, or even ₦500 start going the same way?

Final Thoughts

Is There Any Hope for the Naira? Yes, but it’s not an easy fix.

To revive the naira and restore confidence in it, Nigeria needs to:

• Tackle inflation through sound monetary and fiscal policy

• Diversify the economy away from oil

• Boost production and exports to strengthen foreign reserves

• Invest in infrastructure and education to build long-term competitiveness

• Create policy consistency to attract foreign investment and restore consumer trust

It’s a long road. But it’s the only way forward.

So the next time you see a ₦20 note lying around, don’t think of it as a worthless piece of paper but as a reminder.

A reminder of what was.

A reminder of what could have been.

And hopefully, a reminder of what still can be, if we get our economic house in order.

Bravewood provides Nigerian professionals with low-risk, high-return investment products, licensed by the Central Bank of Nigeria.