The most important rule of investment is the need for portfolios instead of individual investments. An investment portfolio will enable you to be more strategic with investments while reducing the possibility that you would lose everything to a single bad investment.

Asides learning how to build an investment portfolio, it is also important to note that the portfolio you use in your 20s will be inappropriate (or too risky) in your 50s. Learning to balance out your asset allocation over the years, is key to creating an effective investment portfolio.

Read more: The 5 Golden Rules of Investing

How to create an investment portfolio

1. Start by dividing your principal into 3 segments.

- Segment 1: Conservative fund (very safe) e.g. Bravewood Prime.

- Segment 3: Balanced fund e.g ETFs, Index fund, and Mutual funds, etc.

- Segment 2: Aggressive fund (more risk) e.g. Equities, Forex, Crypto trading fund, etc.

2. Assign percentages to each segment based on your life stage.

3. Adjust with age.

Let’s explore sample portfolios for each age group:

- Age 18 – 25

- Age 25 – 35

- Age 35 – 45

- Age 45 – 55

- Age 55+

Investment portfolio for each age-group

Age 18 – 25

- Segment 1: Conservative fund (A very safe instrument like Bravewood Prime) – 20%

- Segment 2: Aggressive fund – 60%.

- Segment 3: Balanced fund – 20%.

As a millennial, you still have time to grow. So, you can choose to be aggressive with your investments. Try out Forex (make sure to learn as much as you can before delving into this), Cryptocurrency, and even day trading. Just have fun and explore the world of investment while growing your money with the power of compound interest.

Age 25 – 35

- Segment 1: Conservative fund (A very safe instrument like Bravewood Prime) – 40%

- Segment 2: Aggressive fund – 50%.

- Segment 3: Balanced fund – 10%.

At this age, you can still try out some aggressive investments. Even if a fund goes bad and you lose money, you’ll still have time to recover.

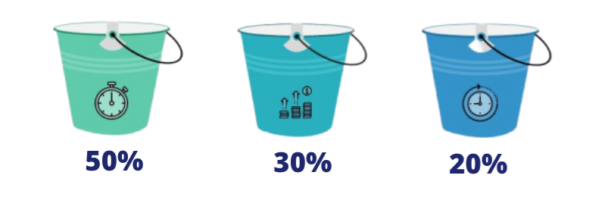

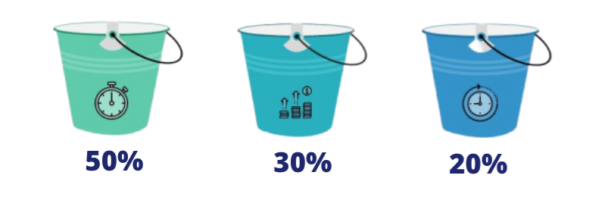

Age 35 – 45

- Segment 1: Conservative fund (A very safe instrument like Bravewood Prime) – 50%.

- Segment 2: Aggressive fund – 30%.

- Segment 3: Balanced fund – 20%.

At this age, it is advisable to focus more on conservative funds in order to grow your money with less risk. This is when to start reducing your risk because you most probably now have dependents.

Age 45 – 55

- Segment 1: Conservative fund (A very safe instrument like Bravewood Prime) – 60%.

- Segment 2: Aggressive fund – 20%.

- Segment 3: Balanced fund – 20%.

Your late 40s to early 50s is a time to be more conservative than aggressive. Even though you may want some growth, fund safety should now be the key consideration for your investment portfolio.

Age 55+

- Segment 1: Conservative fund (A very safe instrument like Bravewood Prime) – 70%.

- Segment 2: Aggressive fund – 10%.

- Segment 3: Balanced fund – 20%.

At this age, you should be mostly conservative. This is NOT the time to play games. Retirement is close.

Want to safely grow your money? Choose Bravewood. We are the wealth-building partner you deserve.