In many African and diaspora communities around the world, there exists a phenomenon known as “Black tax.”

Initially coined in South Africa, the concept refers to the financial support that individuals, often first-time professionals or the more economically successful members of a family, provide to their extended families. This support can include paying for siblings’ education, assisting with household expenses, or contributing to other family related bills.

While this practice is deeply rooted in African cultural values, it raises complex questions about family responsibility, economic inequality, and personal aspirations. Is Black tax a good or a bad thing? The answer depends on whom you ask, as it can be both a blessing and a burden. Below, we’ll explore the complex nature of black tax, understanding its history, cultural significance, and the various ways it impacts Black lives around the world.

The History of Black Tax

The concept of black tax has its roots in the historical racial inequalities that have persisted for generations. In South Africa, the term gained prominence in the post-apartheid era, when the first generation of black professionals found themselves with unprecedented economic opportunities. However, these individuals often came from families and communities that had been systematically disadvantaged by apartheid policies, creating a stark economic disparity within families.

In the United States, while the term “black tax” may not have been as widely used historically, the concept has long been a reality for many Black Americans. The effects of slavery, Jim Crow laws, and ongoing systemic racism have created generational wealth gaps, making it common for more financially stable black individuals to support their extended families.

As black people gained economic and social mobility, they often felt a moral obligation to help those who had been left behind.

In a nutshell, the origins of black tax can be traced to these factors:

1. Systemic racial discrimination in education and employment

2. Limited access to wealth-building opportunities (e.g., homeownership, business loans)

3. Generational poverty resulting from these systemic barriers

4. Cultural values emphasizing family and community support

As a result, black tax emerged as both a necessity for survival and a cultural expectation within many black communities.

Positive Aspects of Black Tax

1. A Reflection of African Values

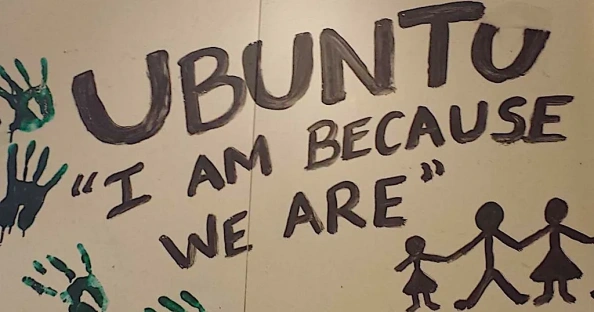

At the core of black tax is the principle of Ubuntu, a Southern African philosophy meaning “I am because we are.” In many African cultures, the family is seen as an interconnected unit where one’s success is the success of all, and one’s struggle is shared by the collective. This deep-rooted sense of communal responsibility is not new. Long before the term “black tax” was coined, African societies thrived on the concept that the well-being of the individual is tied to the well-being of the group.

For example, in Yoruba culture, the saying that “One’s relation cannot be on the top of a cherry tree and one eats an unripe cherry,” encapsulates this philosophy. Black tax, therefore, becomes an extension of these cultural values. It’s a way of ensuring that those who have benefited from opportunities—often rare in communities that have been disadvantaged—give back to those who supported them. This is a positive cultural tradition that reflects values of family, community, and interconnectedness. It serves as a reminder that individual success is often built on the sacrifices made by previous generations.

2. Strengthening Family Bonds

While the financial aspect of black tax can be challenging, it also serves as a social glue that binds families together. The shared responsibility of helping one another fosters stronger family ties and promotes a sense of belonging. This collective effort often leads to collective well-being. For instance, a family member who receives support through black tax to complete their education may later be in a position to help younger relatives, creating a cycle of upliftment.

Families that practice black tax are engaged in a form of social solidarity, where the success of one member can lift an entire household or community. This creates a multi-generational ripple effect, where the future generations are better positioned to succeed because of the support system in place.

3. Economic Empowerment

One of the more underappreciated aspects of black tax is the way it can contribute to economic empowerment. In some cases, black tax serves as a form of informal venture capital, helping entrepreneurs or small business owners within the family.

For instance, a sibling may contribute to a family member’s small business, helping them get started or sustain their venture. This can have a multiplier effect, creating wealth not only for the individual but for the family as a whole.

In this sense, black tax functions as a form of informal venture capital, where pooling resources helps to establish family businesses that would otherwise struggle to secure funding in formal financial markets. These businesses, in turn, often become sources of pride and economic stability for the broader family network.

Negative Aspects of Black Tax

1. Stress and Debt

Despite its positive cultural implications, black tax can place a significant financial burden on individuals, especially those who are just starting their careers. The pressure to provide not only for oneself but also for extended family members can lead to stress, debt, and reduced economic mobility. Many young professionals find themselves juggling their own living expenses, student loans, and future savings goals while also covering costs for family members who may not have the same financial opportunities.

This can lead to a vicious cycle of debt, where individuals feel they can never get ahead financially because a portion of their income is always being directed elsewhere. The emotional toll of feeling obligated to support family members, combined with the financial strain, can lead to burnout and, in some cases, even resentment.

2. The Gendered Impact

Black tax does not affect all family members equally. In many cultures, the burden disproportionately falls on women, who are often expected to take on caregiving roles in addition to their financial responsibilities. According to research, women are more likely to provide financial support to their families, even when they earn less than their male counterparts. This creates an inequitable distribution of financial obligations that can deepen gender inequalities within families.

In some cases, women may delay their own career aspirations or personal development because they are expected to prioritize family needs over their own. This not only limits their individual growth but also contributes to broader systemic issues around gender and financial independence.

3. Limiting Personal Goals

Black tax significantly limits personal goals by forcing individuals to make sacrifices in career advancement, education, and personal development. For instance, someone may turn down a promising job opportunity in another city because they are financially responsible for family members who depend on them locally. Others may delay further education or critical life milestones, such as buying a home or starting a family, because of the financial obligations imposed by black tax.

Over time, this breeds frustration and traps them in a cycle of financial dependence.

A More ReDefined Approach

1. Contextualizing Black Tax

To fully understand black tax, it’s important to consider the historical and socio-economic context in which it exists. The practice didn’t emerge in a vacuum but is a response to generations of systemic inequality and limited access to resources.

Recognizing these contextual factors allows for a more nuanced discussion about black tax, acknowledging both its necessity in many situations and the systemic changes needed to alleviate the pressure on individuals and families.

2. Reimagining Family Support

While black tax in its traditional form can be burdensome, some families are exploring alternative models of family support that emphasize collective wealth-building. Instead of individuals giving a portion of their income directly to relatives, families can pool their resources to invest in real estate, government securities, shared ownership of assets, or set up/maintain small businesses that benefit the entire family in the long run. This approach shifts the focus from immediate needs to long-term financial stability, helping to create wealth that can be passed down through generations.

This reimagined model of black tax encourages financial literacy and investment within families, ensuring that support is sustainable and that individuals are not financially drained in the process.

3. Balancing Individual and Family Needs

Navigating black tax requires finding a balance between individual financial goals and family obligations. For those facing the pressures of black tax, setting clear financial boundaries is essential. This can include creating a budget that accounts for family support while also prioritizing personal savings and investments. Open communication with family members about one’s financial limitations can also help manage expectations and reduce stress.

Moreover, families can work together to create exit strategies, where financial support is gradually reduced as other family members become more self-sufficient. This ensures that individuals can still contribute to their family’s well-being without sacrificing their own financial future.

Final Thoughts

Black tax is neither inherently good nor bad. It’s a complex socio-economic phenomenon with both positive and negative impacts on black communities. Its cultural significance and role in fostering social solidarity are undeniable, as is its potential to create opportunities for economic empowerment. However, the financial burden and potential to limit personal growth cannot be ignored.

The key lies in finding a delicate balance that honors cultural values and family obligations while also allowing individuals to build financial stability and pursue their aspirations.

Ultimately, the goal should be to create a future where the spirit of communal support remains strong, but where systemic barriers have been dismantled to the point that “black tax” is no longer a necessity for survival, but a choice rooted in cultural values and genuine ability to give.

Bravewood is licensed by the Central Bank of Nigeria to provide investments with low risk and high returns for Nigerian professionals.