If Nigeria’s economy was a movie in 2024, it would be a thriller with enough plot twists to keep audiences on the edge of their seats. As we present our Nigeria economic review 2024, let’s break down this dramatic year in a way that won’t make your head spin.

Starting With a Bang: January to March

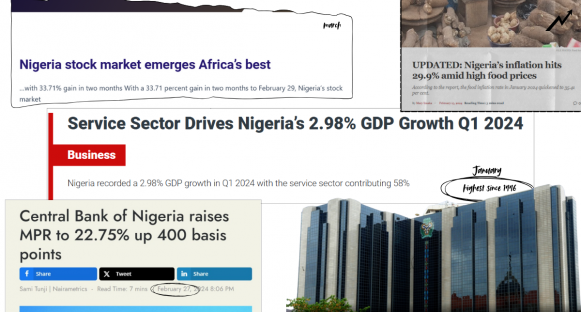

Remember when everyone was complaining about prices in January? Well, the numbers backed up those complaints – inflation hit a jaw-dropping 29.9%, the highest since 1996. To put that in perspective, that’s the highest since before any Gen-Z individual was born.

The Central Bank wasn’t sitting idle though. In February, they made what you might call a “power move” – hiking interest rates by 400 basis points. In regular speech? They were trying to stop the Naira from doing the limbo (going lower and lower).

But here’s the plot twist – despite all this drama, Nigeria’s stock market decided to be the superhero of Africa, becoming the continent’s best-performing market with a stunning 33.71% gain in just two months. Talk about a silver lining!

The Plot Thickens: April to June

Just when Nigerians were getting used to high electricity bills, NERC dropped a bombshell in April – a 230.88% increase in electricity tariffs for Band A users. This dramatic development marks one of the most significant moments in our Nigeria economic review 2024, as it affected households and businesses across the nation.

Meanwhile, the Central Bank was playing whack-a-mole with inflation, raising interest rates again and again. By May, it felt like they were throwing everything at the problem just to find a solution.

The Middle Act: July to September

July was like watching a seesaw in action. The stock market couldn’t make up its mind – Industrial Goods were down, Consumer Goods were down, but then Oil and Gas decided to party in August.

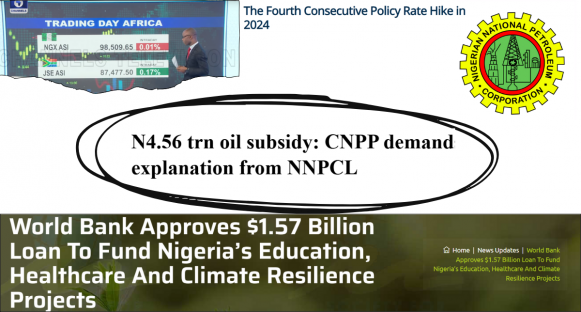

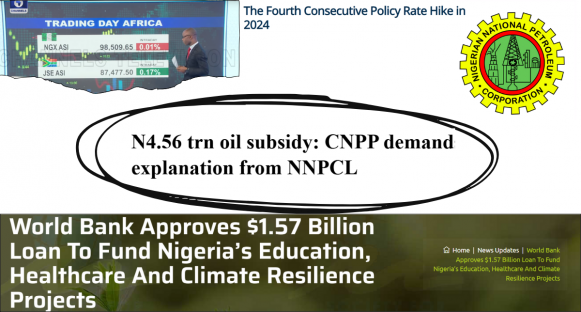

Here’s a move that shocked Nigerians tremendously – NNPCL revealed Nigeria owed ₦4.56 trillion thanks to subsidized petrol prices. That’s trillion with a ‘T’!

But September brought some good news and the World Bank stepped in with a $1.57 billion loan.

The Grand Finale: October to December

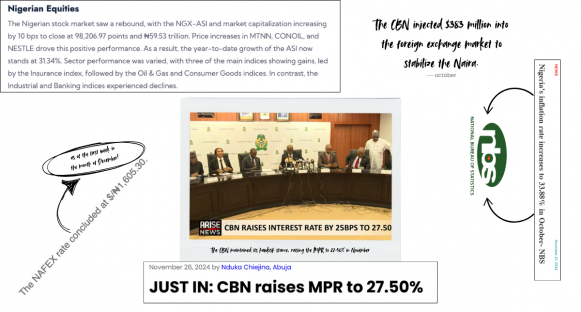

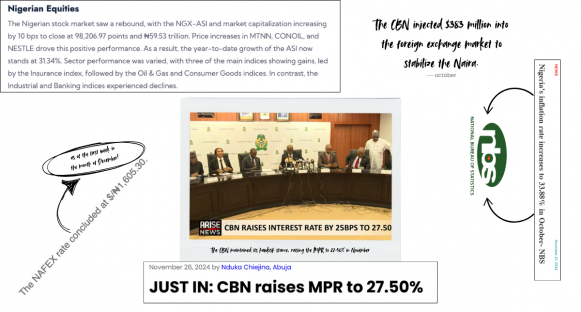

The final quarter of 2024 presented continued challenges in managing inflation, which remained stubbornly high at 33.88%. The CBN maintained its hawkish stance, raising the MPR to 27.50% in November. The stock market showed mixed performance, with November marking its first negative close in five years.

But December? December brought some holiday cheer to the markets. The Naira started showing signs of finding its footing, and the stock market gave us a nice year-end present with some positive gains.

What Does It All Mean for Regular Nigerians?

Here’s the real talk – 2024 was tough on Nigerian wallets. From higher electricity bills to pricier food, everyone felt the pinch. But it wasn’t all doom and gloom:

– The stock market’s performance showed that even in tough times, there’s money to be made

– The Naira’s late-year stability hints at better days ahead

– International support (like that World Bank loan) suggests global confidence in Nigeria’s potential

Looking Ahead

While 2024 might not have been the economic paradise we hoped for, it showed Nigeria’s resilience. Think of it this way – we’ve survived one of the most challenging economic years in recent memory, and we’re still standing.

As we move into 2025, there are signs of light at the end of the tunnel. The question isn’t just whether things will get better, but how we’ll use the lessons from 2024 to build a stronger economy.

Remember, every economic crisis in history has eventually ended. Nigeria’s story is still being written, and if 2024 taught us anything, it’s that we’re tougher than we think.

Bravewood provides Nigerian professionals with low-risk, high-return investment products, licensed by the Central Bank of Nigeria.