Ever sat alone at the end of the day, phone in hand, staring at your bank balance with that sinking feeling in your chest? Not because you splurged. Not because you went on some wild shopping spree. But because life, plain, everyday life is draining you dry.

Rent. School fees. Black Tax. Groceries. That random contribution to a friend’s wedding. Maybe that item you didn’t need but felt you had to buy because… well, expectations.

If this sounds familiar, you’re not imagining things. You’re carrying a load that many men are silently crushed under every day. From early on, society hands you a script: Be the provider. Be dependable. Stay strong. Never complain. Always show up. Always afford it.

But at what cost?

The Weight of Silent Expectations

In many Nigerian homes, men are raised with one clear expectation: Provider. For the most part, it’s not always said out loud, but it’s written between the lines of family conversations, reinforced in church sermons, and cemented in pop culture.

And when income doesn’t rise at the same pace as inflation, that traditional role becomes less of a badge of honor and more of a burden.

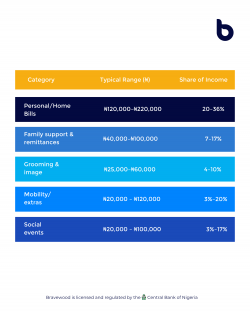

Consider this: A man living in Lagos or Abuja earning ₦600,000 monthly might look “comfortable” on paper. But when you break it down like our research did, it tells a different story.

Before long, it’s clear, being “the man” means being stretched. Financially. Emotionally. Mentally.

There’s Also the Pressure to Look the Part

According to a survey by BusinessDay, 57.1% of young Nigerian men admitted to frequent impulse spending, primarily driven by social or emotional pressure. That’s more than half of men, regularly swiping their cards, not necessarily because they need something, but because they need to be seen as someone who has it all together.

That means nice clothes, a clean haircut, a decent car, and the ability to pick up the tab when it counts. No one wants to be the guy who says, “I can’t afford that right now.”

And more often than not, this often leads to a dangerous spiral:

• Working longer hours or juggling multiple jobs.

• Taking on debt to meet expectations.

• Feeling inadequate or “less of a man” when you fall short.

Sound familiar?

Masculinity, when tied too tightly to financial dominance, creates a loop of pressure:

Make more money → Spend to prove your worth → Struggle to save or invest → Feel inadequate → Repeat.

This loop is harmful. And clearly, something’s got to give.

A Mindset Shift

The answer isn’t to stop providing or caring for others. Instead, it’s about a mindset shift. One from a cost-centered living to an investment-centered thinking.

As a man going through any of these, here are three powerful questions you should sit with that’ll help guide this shift:

1. What does “success” mean to me?

Is it about how much I spend, or how much freedom I have?

2. Where could my money go if I stopped ditching the unnecessary expenses for a month?

Could I build a buffer? Pay off debt? Invest?

3. How many years ahead am I planning for?

Are you living paycheck to paycheck to impress people today, or planning for the man you want to be at 40, 50, or 60?

Because in truth, financial freedom isn’t obtained by taking on so many financial responsibilities or seeking the approval of others, it’s built through small but smart intentional choices that compound your growth.

For instance, when you start redirecting part of your income toward savings, investments, or even just peace of mind (yes, a financial buffer is peace of mind), you start to regain control. You stop chasing the approval of others and start building the life you want.

And that, my friend, is the real flex.

Bravewood provides Nigerian professionals with low-risk, high-return investment products, licensed by the Central Bank of Nigeria.