As the year winds down, it is a season where families gather around shared meals, quiet moments of reflection, and the simple joy of giving without expecting anything in return.…

As the year winds down, it is a season where families gather around shared meals, quiet moments of reflection, and the simple joy of giving without expecting anything in return.…

In 2025, Nigerian investors increasingly embraced a powerful financial principle: wealth can grow without constant effort when capital is strategically invested. While daily economic activity slowed overnight, structured investments continued…

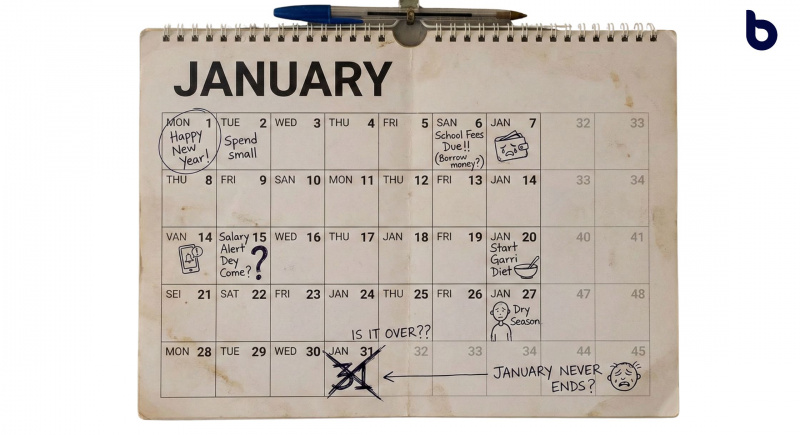

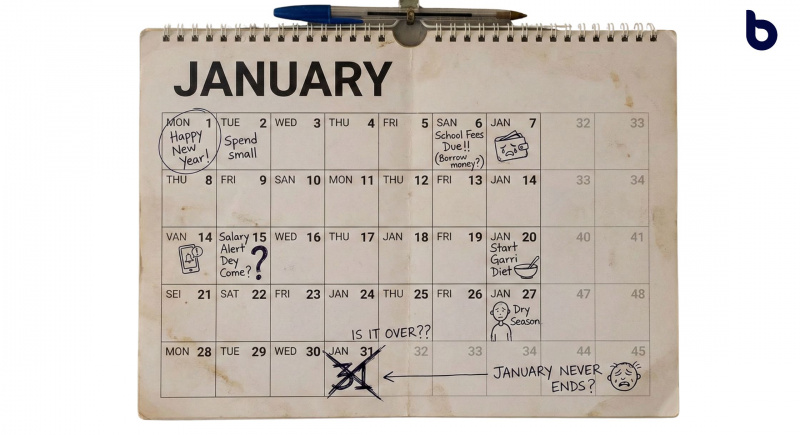

If you’ve ever looked at the calendar on January 12th and whispered, “Ah-ah, why are we still in January?”, you’re not alone. January is that month that behaves like a…

As the year winds down, it’s the perfect time to review your investment portfolio and make sure it’s still aligned with your goals. For many Nigerian investors, life moves quickly.…

Imagine planting a seed today that not only grows into a tree, but also plants new seeds every year on its own. Those new seeds sprout into more trees, which…

Your greatest investment risk isn’t the market, it’s your emotions. For many Nigerian investors, emotions often drive impulsive buy or sell decisions. Panic, excitement, or fear can quickly change the…

Let’s be candid: for the majority, financial strength isn’t built on a single, lucky trade. Wealth creation is the consistent execution of simple financial habits, high-leverage practices that compound over…

The way we invest is changing, and Artificial Intelligence (AI) is the secret weapon. Forget the complicated terms, think of AI as the world’s fastest, smartest financial analyst working 24/7.…

Ever sat alone at the end of the day, phone in hand, staring at your bank balance with that sinking feeling in your chest? Not because you splurged. Not because…

Every November, millions of men around the world put down their razors and embrace the awkward, patchy journey of growing a mustache to celebrate Movember – a global movement raising…

If you’re a Nigerian looking for a safe and rewarding place to invest your money, here’s some good news: the Federal Government of Nigeria (FGN) Savings Bond is back, and…

Let’s talk about something that affects every single one of us: money. No cap – money can be tight. We won’t just talk about spending it, but growing it. If…

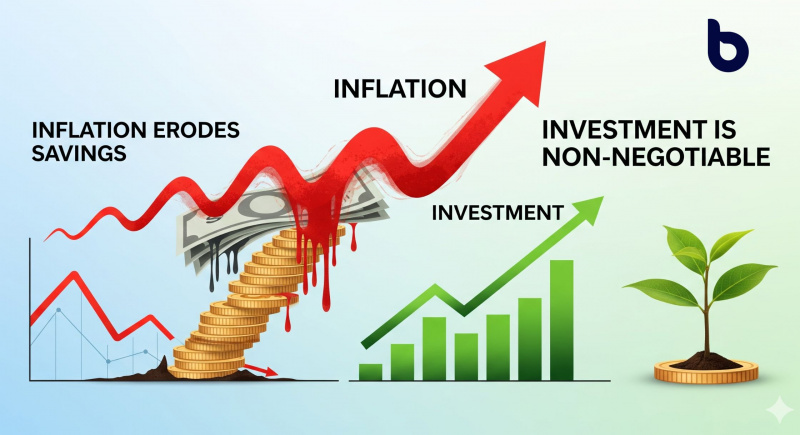

Remember when ₦20 could actually buy something?

If you’re old enough, you might recall the days when ₦20 could fill your stomach, fuel your car, or restock your pantry. Now? It practically doesn’t exist…

Have you ever seen Bravewood’s bold “B” logo and wondered, “What’s inside that B?” Picture it as a secret vault: inside are the tools, tips, and team that help you…

Every powerful movement begins not with a declaration, but with a question. A question that stirs the soul, challenges the status quo, and dares to imagine a better future. That…

As we gather to celebrate Independence Day, we’re reminded that freedom takes many forms. While our heroes fought for political independence years ago, today we recognize another vital freedom: financial…

Many Nigerians keep money in savings accounts because it feels safe. You can view the balance at any time, withdraw funds when needed, and there’s no perceived risk. But this…

Picture this: You’ve been saving ₦500,000 in your bank account for the past year. You check your balance regularly, feeling secure because the number hasn’t changed. But here’s the uncomfortable…

No one wants to think about dying, but if you left this world tomorrow without a will, the impact on your loved ones can be painful. In Nigeria, failing to…

Let’s be real for a second. You work hard. You hustle. You answer emails at 11 PM, skip lunch to meet deadlines, and’ve mastered the art of looking awake on…

As the calendar flips through September, the days are getting shorter, and a certain buzz is starting to build. December is just around the corner, and if you’re like most…

In Nigeria today, tax is a constant presence, affecting everyone from a corporate CEO to a street trader. It’s no longer just a distant government policy; it is in your…

In Nigeria, being a parent often means wearing many hats: provider, teacher, peacekeeper, and sometimes, magician. Every year, September comes knocking, and with it, the familiar weight of school fees,…

If you’re a Nigerian parent, chances are that you already know the September feeling. The feeling of the month when schools reopen. The children are back in uniform, bags packed,…

Remember that feeling of getting your first allowance? It felt like all the money in the world. You saved up for a new video game console, a pair of sneakers…

Every year, when September rolls by, Bimbo, a 37-year-old career professional, feels a familiar mix of excitement and worry. She loves the ember months, you know, family gatherings, weddings, Christmas…

Every big change starts with a simple idea. For us, it began with two people, two people from different worlds but with the same dream: to build a wealth movement for Nigerians by Nigerians…