Remember that feeling of getting your first allowance? It felt like all the money in the world. You saved up for a new video game console, a pair of sneakers…

Remember that feeling of getting your first allowance? It felt like all the money in the world. You saved up for a new video game console, a pair of sneakers…

Every year, when September rolls by, Bimbo, a 37-year-old career professional, feels a familiar mix of excitement and worry. She loves the ember months, you know, family gatherings, weddings, Christmas…

Every big change starts with a simple idea. For us, it began with two people, two people from different worlds but with the same dream: to build a wealth movement for Nigerians by Nigerians…

Over the weekend, something quietly intriguing happened on Nigerian TV, and no, it wasn’t another Big Brother eviction or celebrity scandal…

Sometime this past weekend, social media caught fire… again. But it wasn’t over politics or celebrity drama. This time, it was about something far more personal…

Life often comes at us in waves. Sometimes calm and predictable, other times wild and uncertain. Yet, in its flow, one truth remains: the decisions we make today ripple through…

Have you ever thought about what happens after you hit your wealth goal? For some, it’s when they make their first million; for others, it’s that hundred-million mark. However, the big…

In a place where inflation often feels like a moving train with no brakes, figuring out how to save or invest in Nigeria is more than just a smart decision,…

We all know the golden rule of personal finance: Always have an emergency fund. It’s your financial safety net, your “just in case,” your peace of mind on a rainy…

Truth be told, when it comes to investing in Nigeria, many of us are skeptical. And who can blame us? The bitter memories of schemes like MMM, CBN Treasury Bills…

Ever met someone who’s always glued to their phone, monitoring stock prices like it’s the Champions League finals? Meanwhile, another person is bragging about buying shares in a company like, let’s say, Dangote Cement back in the day…

It’s 2025, and if there’s one thing we can now all agree on, it’s this: saving your money in a bank is not a wealth-building strategy…

Let’s be honest, Father’s Day doesn’t get as close the hype Mother’s Day gets (which is celebrated twice a year, by the way).

No Instagram tributes laced with emotional captions, no flower bouquets, no choir renditions in church. Most Nigerian dads just get a text message…

Gold. Just hearing the word evokes images of wealth, security, and stability. For centuries, this precious metal has been a universal symbol of value. From ancient empires to modern economies,…

What does playing snooker have to do with investing?

At first glance, not much. Snooker is a game played on a green table with balls and a cue stick…

A few weeks ago, we got tagged in a fascinating Twitter thread. It was about a young man who, four years ago, started investing for children he didn’t even have…

If you’ve ever dreamed of earning steady, guaranteed income while supporting Nigeria’s development, then the June 2025 FGN Savings Bond might just be the golden opportunity you’ve been looking for.…

Let’s be honest: in Nigeria, the word debt often carries a heavy, negative tone. For many professionals, it brings to mind friends dodging loan sharks, salary advances that disappear before the 15th of the month…

Have you ever wondered what people mean when they say they ‘own equity in a company’? If you’ve nodded along without truly understanding what they meant, it’s perfectly understandable…

It shouldn’t be news to you, but somehow, it still is for a lot of people: having more than one bank account is one of the most underrated wealth-building strategies…

What happens when a person who’s meant to help guide others ends up carrying a secret habit capable of ruining his life and that of his family?…

8-year-old Desmond came running to his father one Saturday morning cradling his favorite remote-control car, now in two sad pieces. His eyes, wide with tears and curiosity. “Dad,” he asked,…

On May 12th, 2025, the Debt Management Office (DMO) of Nigeria launched a new ₦300 billion Sovereign Sukuk bond. But what exactly is a Sukuk bond and why should you…

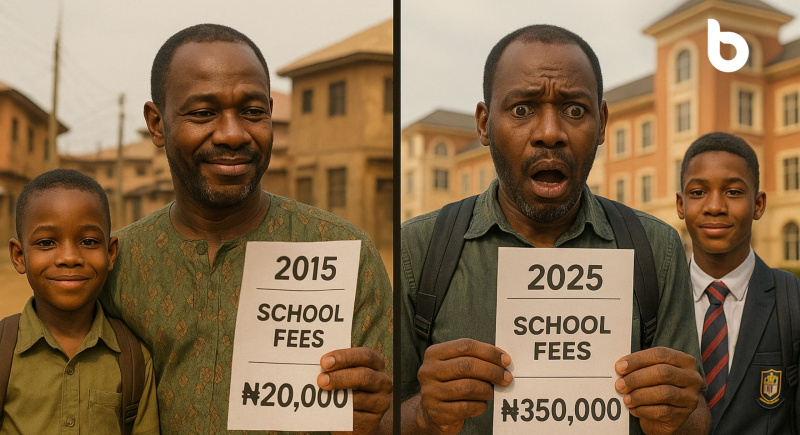

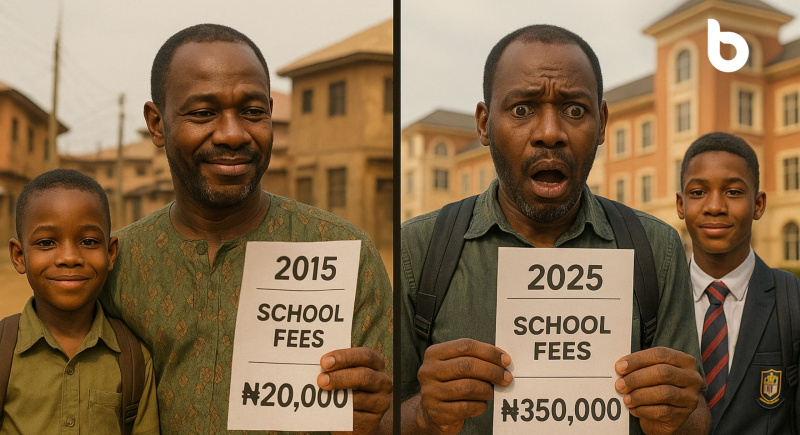

If you’re a parent in Nigeria today, chances are you’ve felt the pinch of rising school fees. Whether your child is in a primary, secondary, or tertiary institution, the cost of education has become one of the most pressing household concerns in recent years…

Have you ever walked into a thrift store and stumbled upon a designer jacket, barely worn, priced like it was just a random jacket? You check the label, feel the quality, and suddenly realize—this thing is worth way more than its price tag suggests…

In today’s hustle culture, especially in bustling cities like Lagos, Nairobi, New York, and even London, burnout isn’t always loud. Sometimes, it creeps in quietly—through late nights, ignored headaches, missed meals, and that one email you answer at 2 a.m…

Barely a week ago, Nigeria was rocked by the collapse of CBEX, a so-called digital trading platform that vanished overnight—taking over ₦1 trillion (about $840 million) of investors’ money with it.