Whether you’re a freelancer, student, stay-at-home mom or full-time employee, we could all use some extra cash. These days, not everyone can comfortably live off their 9 to 5, and…

Whether you’re a freelancer, student, stay-at-home mom or full-time employee, we could all use some extra cash. These days, not everyone can comfortably live off their 9 to 5, and…

Career success means different things to different people, but the common factor required is growth. To achieve this, you need to know what to do to get from where you…

The period of your life when you have to decide on what’s the right career path can prove to be the most nerve-wracking period of your life. While we definitely…

Anyone buying a new car, or just a loaf of bread has noticed that prices are going up. The current fuel scarcity has pushed Nigeria’s inflation rate to 15.7% this…

In order to provide security and a decent standard of living for you and your family, you need to break bad money habits. They can prevent you from reaching your…

During uncertain times, it is vital to get proper financial advice. Due to the pandemic, there has been a temporary closure of businesses, schools, and other public facilities and events.…

There are numerous benefits to building an emergency fund included in your financial plan. Having an emergency fund means saving enough money to cover unanticipated financial situations. This fund is…

Living above your means has become all-too-common in today’s society. With how easy it is to impulse buy online you can easily end up spending more than you make. Living…

To create unique offerings that set you apart, you need to assess your competitors to know who they are and what they bring to the market. Keeping tabs on your…

The simplest way to boost your income is by reducing the amount of money you spend, earning extra money through your job or another source and investing consistently. Thankfully, technological…

Investing is crucial in attaining financial independence and can seem a bit complex for the layman. More often than not, the terms alone have you reaching for a glossary and…

Most people aren’t aware they have an unhealthy relationship with money. Money isn’t the most important thing in the world, but we need it to take care of ourselves. Unfortunately,…

It’s the first week of the month and your salary has finished. Why? If you can’t comprehensively answer that question then this post is for you. Your salary or income…

Have you seen The Tinder Swindler on Netflix? Scammers target people of all backgrounds, ages and income levels across the world. There’s no one group of people who are more…

Setting goals is one thing, achieving them is a different thing entirely. Making a sustainable plan and staying on track month after month, year after year is the only way…

Our first TweetChat of the year featured @gabrielomin who gave us insights on common money mistakes which also happened to be the title of his latest book “45 Common Money…

When looking for a partner, we check for compatibility in different aspects of life but often neglect financial compatibility. Money has long been known to be a leading cause of…

We all want to be successful in our work and lives. Unfortunately, many of us let our current lifestyle choices get in the way. How are you supposed to be…

The big 14th is coming up, and while we can all agree that love is in the air, something else is – bills! No matter how much you plan to…

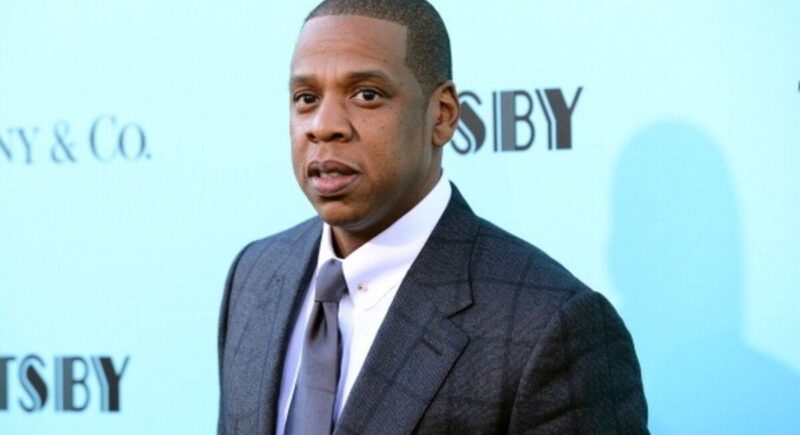

Jay-z American rapper and entrepreneur Jay-Z, born Shawn Corey Carter, is an American rapper, entrepreneur, songwriter, record executive and investor. His business acumen has garnered an estimated net worth of…

It’s the first day of February and we’re super excited to set you on the path to making more in the new month with these money hacks. Improving your finances…

WARREN BUFFETT CEO OF BERKSHIRE HATHAWAY Warren Buffett is an American business magnate, investor, and philanthropist. He is currently the chairman and CEO of Berkshire Hathaway and one of the…

Wealth can’t be built overnight. It requires patience and discipline and every decision you make can bring you closer or farther away from achieving your goals. These are certain steps…

Meet Bukola Smart. She is a multi-talented millennial passionate about helping young people succeed in their financial lives. She is also known for being a personal finance podcast host, speaker…

Smart investing and building a well-diversified investment portfolio can help you achieve your long-term financial dreams. Investing is an effective way to put your money to work and potentially build…

While the world and the job market are changing, there are still some skills that will make you valuable in the present and in the future. One of the ways…

Wealth is built over time, not overnight. By controlling your spending, reducing debt, saving more and investing wisely, you can grow your net worth over time. Here are six easy-to-implement…