Treasury Bills in Nigeria (T-Bills) stand out as a cornerstone of government borrowing and a popular investment option for those seeking low-risk returns. As economic uncertainties persist and Nigerians look for stable investment vehicles, understanding T-Bills becomes crucial for both individual and institutional investors seeking to diversify their portfolios.

What are Treasury Bills?

Treasury Bills are short-term debt instruments issued by the Central Bank of Nigeria (CBN) on behalf of the Federal Government. These government securities serve a dual purpose: they help the government manage its short-term financing needs and provide a mechanism for the CBN to control money supply in the economy. For investors, on the other hand, T-Bills offer a safe, low-risk investment option backed by the full faith and credit of the Nigerian government.

Benefits of Investing in Nigerian T-Bills

The appeal of Treasury bills lie in their simplicity and security. Unlike stocks or real estate, T-Bills don’t fluctuate in value based on market conditions. Instead, they offer a fixed return over a short period, typically 91, 182, or 364 days. This predictability makes them an attractive option for conservative investors or those looking to diversify their portfolio with a stable, low-risk component.

Additionally, income from Treasury Bills is currently tax-exempt, further adding to their appeal for investors. On the flip side, while this is an important benefit, tax laws can change, and investors should stay informed about any potential changes in tax policy.

T-Bill Features, Yields, and Returns

One of the key features of T-Bills is that they are sold at a discount to their face value. For example, a 91-day T-Bill with a face value of ₦100,000 might be sold for ₦97,000. At maturity, the investor receives the full face value, with the difference representing the interest earned. This structure means that investors receive their returns upfront, which can be advantageous for cash flow planning.

Furthermore, the yields on T-Bills fluctuate based on various economic factors, including inflation rates, monetary policy decisions, and overall market liquidity. In recent years, T-Bill yields in Nigeria have been relatively attractive compared to savings account rates, making them a popular choice for individuals and businesses looking to park their short-term funds.

How to Invest in Treasury Bills

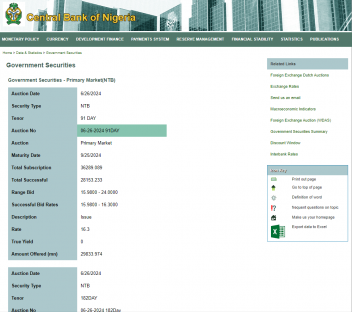

Investing in T-Bills is relatively straightforward. The CBN holds auctions regularly, usually every two weeks, where these bills are sold. Investors can participate either directly through the CBN or through commercial banks and licensed stockbrokers. The minimum investment amount is typically accessible to many Nigerians, making T-Bills a democratic investment option in the Nigerian financial markets.

For many Nigerians, Treasury Bills serve as a gateway to financial markets. They offer a low-risk way to earn returns above inflation, protect savings from currency devaluation, and gain experience in investment practices. This educational aspect is crucial in a country where financial literacy is still developing.

T-Bills and Nigeria’s Monetary Policy

For the Nigerian economy, T-Bills play a crucial role in monetary policy implementation. By adjusting the supply and yields of T-Bills, the CBN can influence interest rates, control inflation, and manage liquidity in the banking system. Understanding this broader economic context can help investors make more informed decisions about including T-Bills in their portfolio.

The Limitations of Treasury Bills and the Importance of Diversifying Your Investment Portfolio

While Treasury Bills offer security and predictability, it’s important to understand their limitations. The returns are generally lower than those of riskier investments like stocks or real estate. Additionally, in periods of high inflation, the real returns (after accounting for inflation) on T-Bills can be minimal or even negative, making investment diversification all the more important.

A well-rounded investment strategy should always include a mix of assets tailored to an individual’s risk tolerance, financial goals, and investment horizon.

Conclusion

Conclusively, Treasury Bills represent an important facet of Nigeria’s financial landscape. They offer a blend of security, accessibility, and reasonable returns that make them attractive to a wide range of investors. As Nigeria continues to develop its financial markets and as individuals become more financially savvy, T-Bills are likely to remain a fundamental component of many investment portfolios.

To this end, understanding T-Bills is not just about grasping an investment option; it’s about comprehending a key mechanism in Nigeria’s economic machinery. For investors, this knowledge can be a stepping stone to more sophisticated financial decisions and a more secure financial future.

Bravewood is licensed by the Central Bank of Nigeria to provide investments with low risk and high returns for Nigerian professionals.