Have you seen The Tinder Swindler on Netflix? Scammers target people of all backgrounds, ages and income levels across the world. There’s no one group of people who are more…

Have you seen The Tinder Swindler on Netflix? Scammers target people of all backgrounds, ages and income levels across the world. There’s no one group of people who are more…

Setting goals is one thing, achieving them is a different thing entirely. Making a sustainable plan and staying on track month after month, year after year is the only way…

Our first TweetChat of the year featured @gabrielomin who gave us insights on common money mistakes which also happened to be the title of his latest book “45 Common Money…

The big 14th is coming up, and while we can all agree that love is in the air, something else is – bills! No matter how much you plan to…

It’s the first day of February and we’re super excited to set you on the path to making more in the new month with these money hacks. Improving your finances…

Wealth is built over time, not overnight. By controlling your spending, reducing debt, saving more and investing wisely, you can grow your net worth over time. Here are six easy-to-implement…

Many of our dreams require money and planning to make them come true. When you have a finite amount of money — as most people do — achieving your financial…

2022 is around the corner and It is never too late to start making smarter financial decisions. For you to be confident with your finances, you need to develop some…

Festive seasons are exciting times, but they could end up leaving you unprepared for what comes after. While shopping and enjoying the festivities, you can easily spend significantly more than…

You’re probably familiar with courses like English, maths, biology, or economics if you went through the Nigerian educational system but not these priceless facts about money. These are some facts…

As the festive season approaches, one of the most experienced challenges with personal finances is cutting down excessive spending. To attain financial freedom, you need to find the balance between…

You don’t actually have to do much to get your finances under control. You just have to follow a few simple personal finance rules to put you on the path…

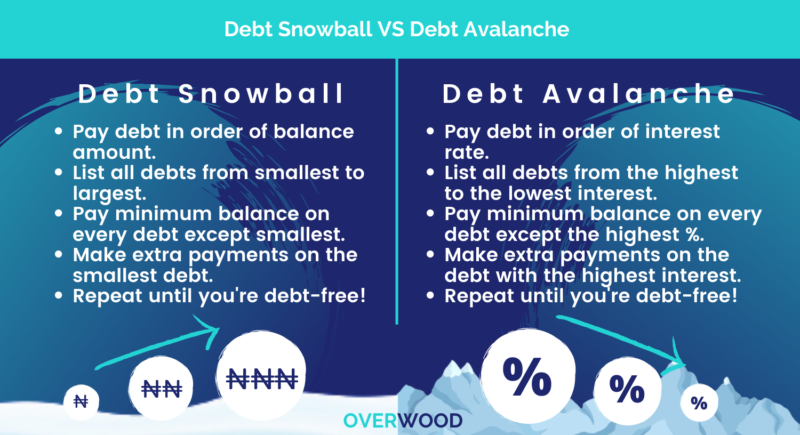

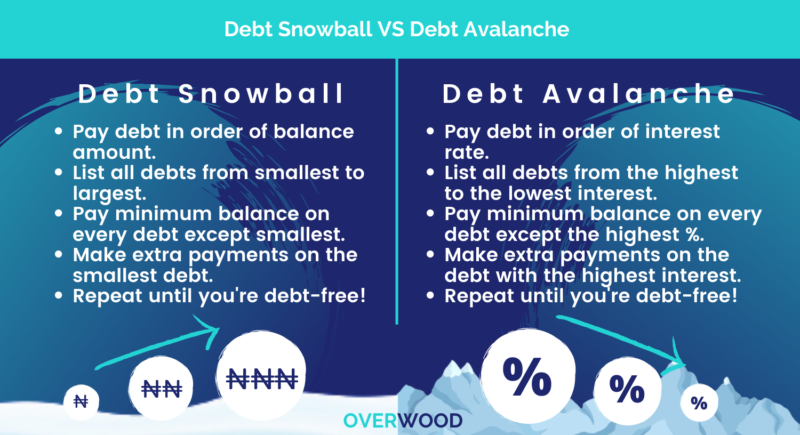

Debt repayment is key to financial freedom. It can be overwhelming to be in debt. If you’ve had enough of all that stress and you’re trying to build a budget…

Spending less and saving more is easier said in theory than done in practice. But spending wisely is an important step in achieving the financial freedom you need, to enjoy…

With compound interest, you’re not just earning interest on your principal, even your interest earns interest compounding your returns. It accelerates the growth of your investment over time. As Benjamin…

Budgets help you maximize your income so you can pay your expenses, achieve your financial goals, and still have money left over for fun! By adopting any of these budgeting…

Living within your means enables you to contribute to your financial goals while providing a cushion in case of an emergency. This is possible only when you’re earning more money…

A major threat to wealth creation is typically viewed as the state of the economy and currency volatility. Even though these events can create uncertainty, it is important to be…

When you manage your finances effectively, you have a better chance of building wealth faster. We’ve all made regrettable decisions about our finances at some point, but the good news…

Wealth is a state of mind, not just your account balance. Societal pressures can have you easily fall into thinking money and status defines wealth but it goes beyond that.…

Raising kids can be expensive. These expenses and the cost of education are rising higher than inflation daily which means that education costs may end up being much higher than…

Studies show that money(finances) is the number-one cause of stress. From getting bills paid to saving or paying off debt and still trying to live in the moment, money plays an…

In your 30’s there’s a major shift in priorities. You might start to consider firmly establishing yourself in your career or business and even start thinking about building a life…

The way you think, feel and manage your money often depends on your money personality. Our money behaviour is deeply rooted in us and is often formed from childhood experiences.…

Setting and achieving financial goals is crucial to living the life you envision for yourself. Having financial resolutions is a really great way to get your finances on track. Everyone…

Budgeting is the easiest way to stay on top of your finances and take control of your money. There are different budgeting methods available depending on your preference and financial…

Every financial decision you make can either bring you closer to being wealthy or take you further away. Developing some basic habits and making intentional choices can be the difference…